salt tax deduction changes

This significantly increases the boundary that put a cap on the SALT. It also changed the eligibility criteria allowing filers to deduct property taxes and state.

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

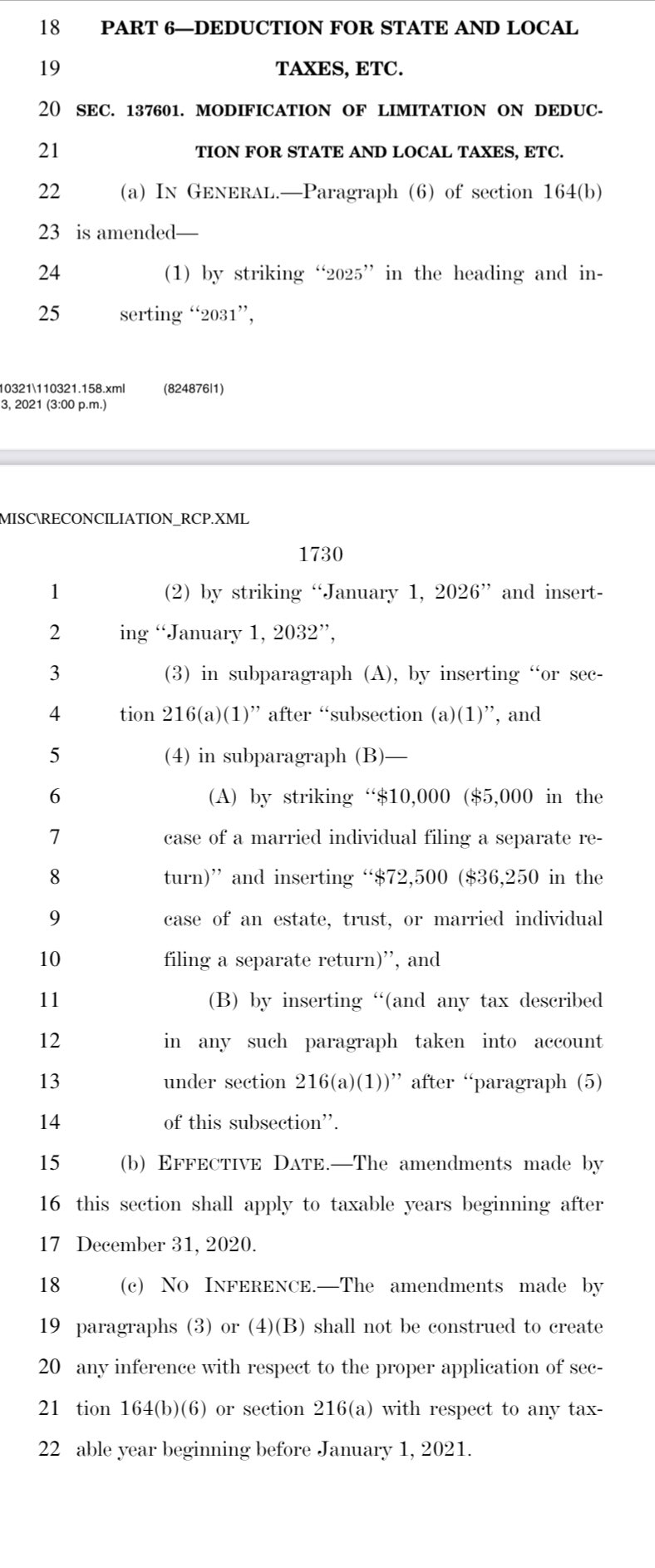

In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire January 1.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. Taxpayers who itemize may deduct up to 10000 of property sales or income taxes already paid to state and local governments. However the 2017 law capped state and local tax SALT deductions at 10000 for the 2018 through 2025 tax years making it less likely youll receive a full tax benefit for those.

Democrats consider SALT relief for state and local tax deductions One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about. In the House members of the so-called SALT Caucus Rep. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments.

The new proposal from the Democrats raises the. New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT.

If the standard deduction was used OR the itemized amount. The change may be significant for filers who itemize deductions in high-tax. In an unsurprising near party-line vote the House tax writing panel.

Josh Gottheimer D-NJ and Rep. The value of the. In 1969 the Alternative Minimum Tax AMT was implemented which limited the.

In 1964 the deduction was changed from applying to all state taxes to instead only certain ones. The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. The maximum SALT deduction is.

Ways Means approves a temporary repeal of the SALT deduction cap. The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The SALT deduction or state and local taxes is already receiving attention as a proposed change that might be controversial for higher income states but it is important to. Tom Suozzi D-NY pushed for the cap to be moved up to at least 75000 but.

Former President Donald Trumps 2017 tax bill capped the deduction to 10000 per year. Before the TCJA there was no cap to the value of the SALT. Reduced SALT and State Tax Changes.

However nearly 20 states now offer a. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. It should indicate whether you used the standard deduction or if an itemized deduction value was used.

Repealing Or Working Around The Cap On State And Local Tax Deductions Would Make The Trump Gop Tax Law Even More Unfair Itep

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Coping With The Salt Tax Deduction Cap

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

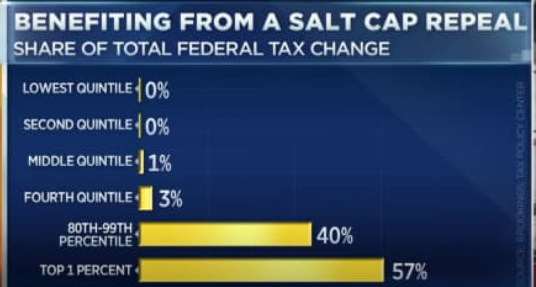

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Cap Increase Ok D By House Now Heads To Senate What May Change

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

N Y Salt Charitable Contribution Plan Fizzles Out Yonkers Times

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

Here S What Could Change Your U S Property Tax Bill In 2022 And Beyond Mansion Global

Local House Members Including Republicans Pushing To Change Key Part Of Trump Tax Law Orange County Register

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities